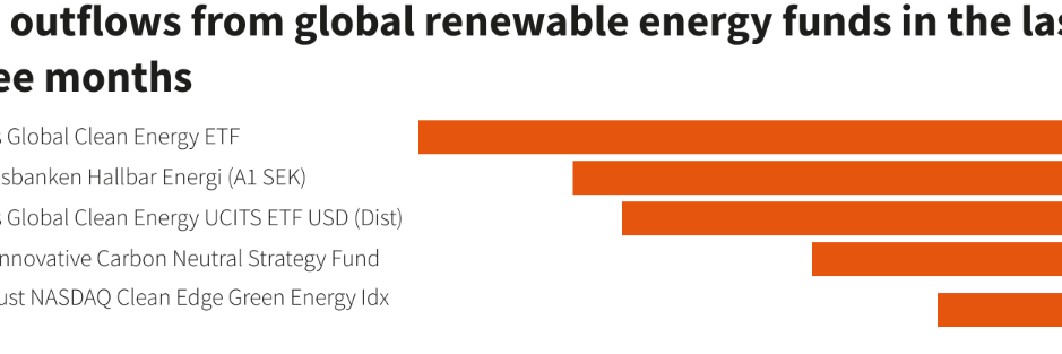

The benefits of funds investing in new energy include potential for high returns and alignment with environmental goals. However, the risks involve market volatility, technological uncertainties, and regulatory changes. Balancing these factors is crucial for investors considering new energy fund investments.

Introduction

The shift towards renewable energy sources has been a transformative trend in the global market, with many investment funds increasingly allocating capital into new energy sectors. However, the decision to sell these investments raises questions about the potential benefits and drawbacks. This article delves into the pros and cons of funds selling into the new energy sector, aiming to provide a comprehensive analysis.

The Pros of Selling into the New Energy Sector

1. Market Diversification

Investment funds often sell into new energy sectors as a strategy to diversify their portfolios. By reducing exposure to one sector, they can spread their risk across various industries, which can be beneficial in the long run.

2. Potential for Higher Returns

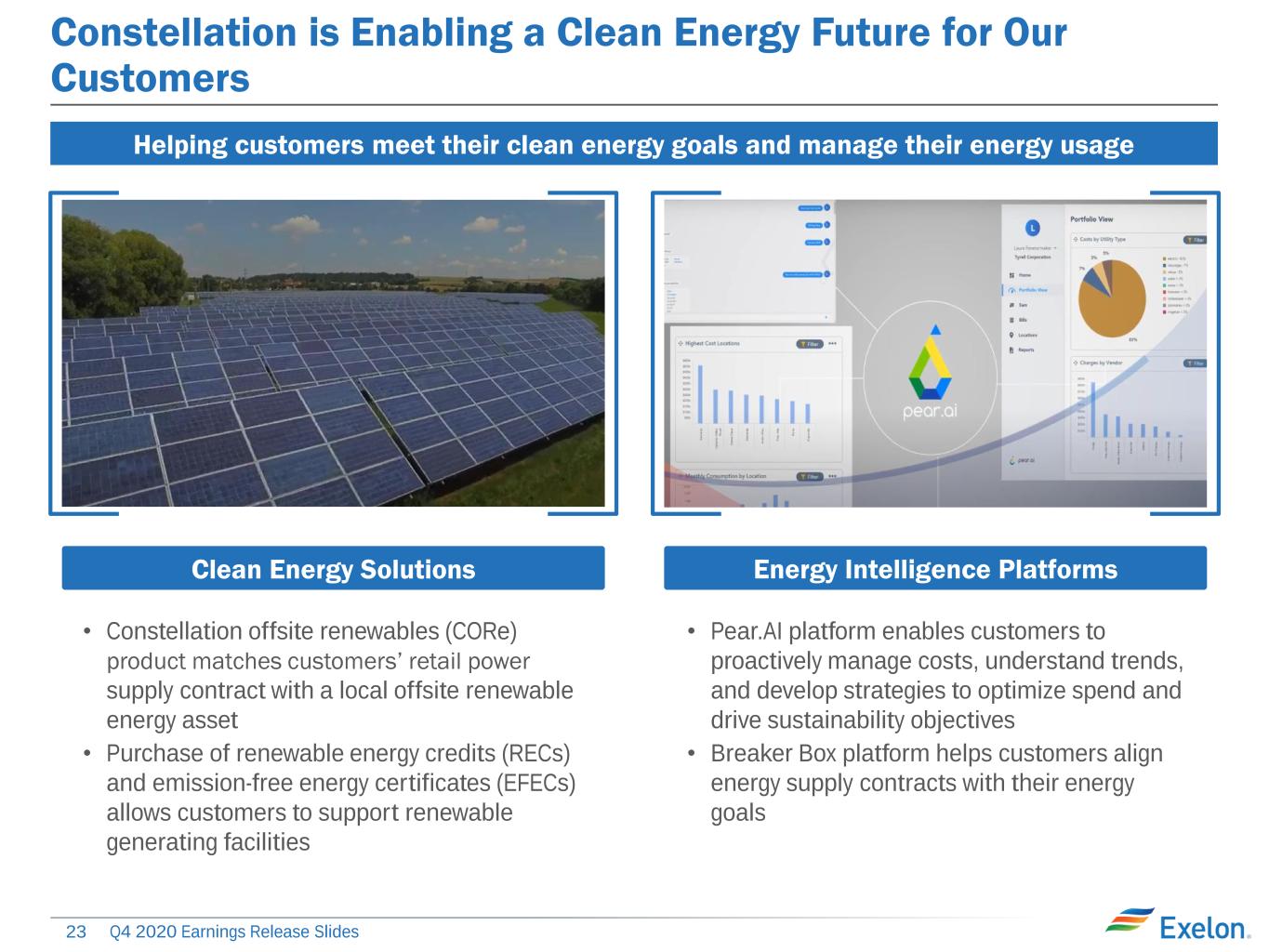

New energy sectors, such as solar, wind, and electric vehicles, are often seen as high-growth markets. Selling into these sectors can allow funds to capitalize on the potential for higher returns compared to traditional energy sources.

3. Regulatory Incentives

Governments around the world are implementing policies and incentives to promote the adoption of renewable energy. Selling into new energy sectors can enable funds to benefit from these incentives, including tax breaks and subsidies.

4. Technological Advancements

The new energy sector is characterized by rapid technological advancements. By selling into this sector, funds can gain exposure to innovative companies and technologies that have the potential to disrupt the market.

The Cons of Selling into the New Energy Sector

1. Early Stage Risks

New energy sectors are often in their early stages of development, which can come with higher risks. These risks include technological uncertainties, regulatory challenges, and market volatility.

2. High Initial Costs

Investing in new energy technologies can require significant upfront capital. Selling these investments prematurely might result in missed opportunities for long-term growth.

3. Dependency on External Factors

The performance of new energy sectors can be heavily influenced by external factors, such as government policies, market demand, and global economic conditions. Selling into these sectors might expose funds to unpredictable market fluctuations.

4. Loss of Tax Incentives

Many governments provide tax incentives to encourage investment in new energy sectors. Selling these investments prematurely could lead to a loss of these incentives, which can be a significant financial setback for funds.

Conclusion

The decision for investment funds to sell into the new energy sector is a complex one, with both compelling advantages and notable disadvantages. While diversification, potential for higher returns, and regulatory incentives are strong arguments for selling, the risks associated with early-stage investments, high initial costs, and dependency on external factors cannot be overlooked. Ultimately, funds must carefully weigh these pros and cons to make informed decisions that align with their investment strategies and risk tolerance.

Keywords: fund, new energy sector, investment, pros and cons, market diversification, higher returns, regulatory incentives, technological advancements, early stage risks, high initial costs, external factors, tax incentives

京公网安备11000000000001号

京公网安备11000000000001号 京ICP备11000001号

京ICP备11000001号

还没有评论,来说两句吧...